Payment Gateway Integration: Optimizing Your Checkout for Maximum Conversion & Security

Are customers abandoning their carts at the final payment step? Are you worried about payment security and PCI compliance? Or perhaps you're losing international sales because your payment options don't support local currencies and payment methods? The payment experience isn't just a technical requirement—it's the moment of truth where browsing transforms into revenue. A single friction point can undo all your marketing efforts and product development. So, why treat payment integration as an afterthought?

At Trinity DEV, we provide strategic payment gateway integration services that transform your checkout from a potential obstacle into a competitive advantage. We don't just connect payment processors; we architect seamless, secure payment experiences that build customer trust, maximize conversion rates, and support your global growth ambitions. Think of us as your partners in revenue optimization, ensuring every potential sale becomes a completed transaction.

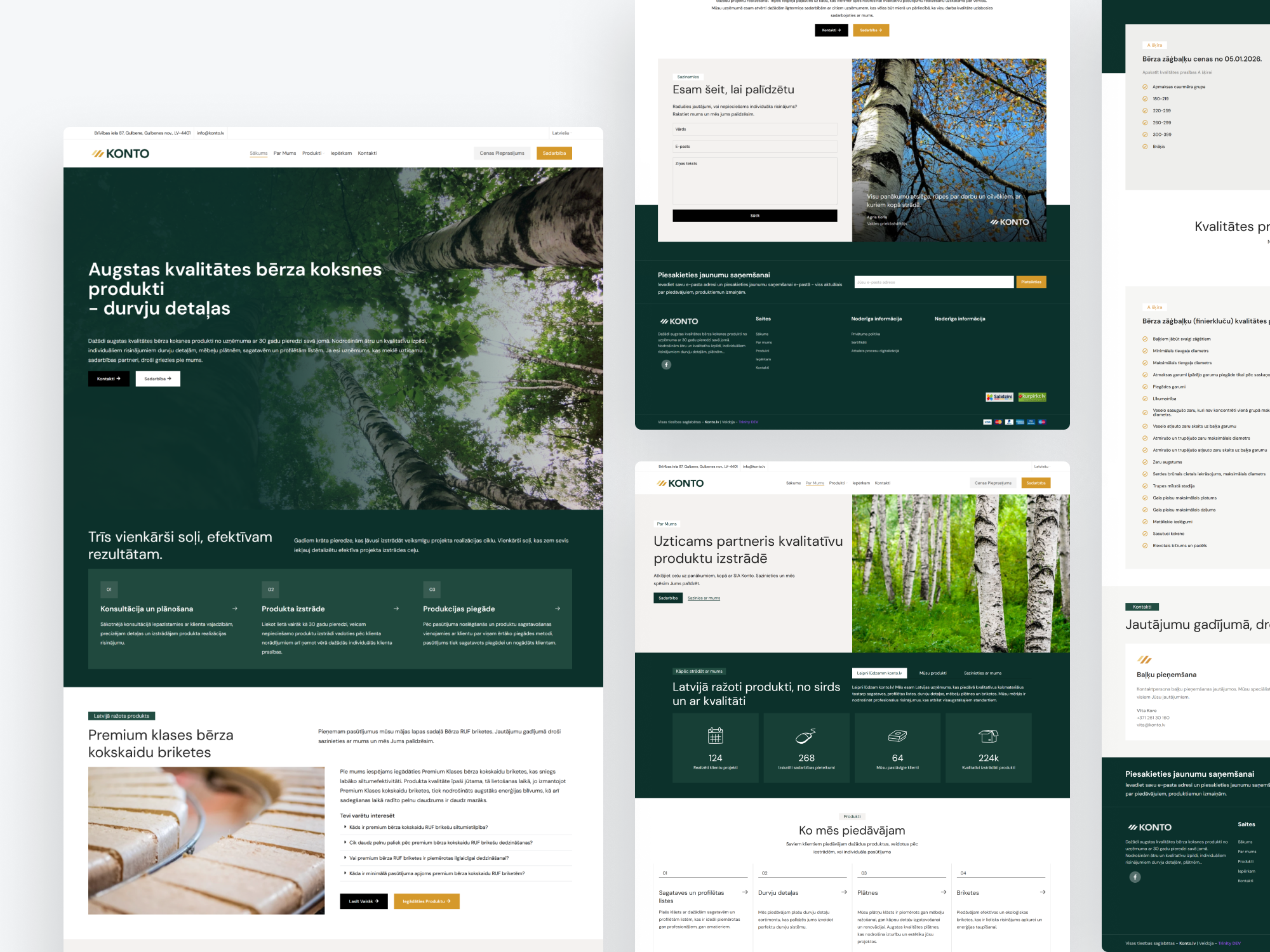

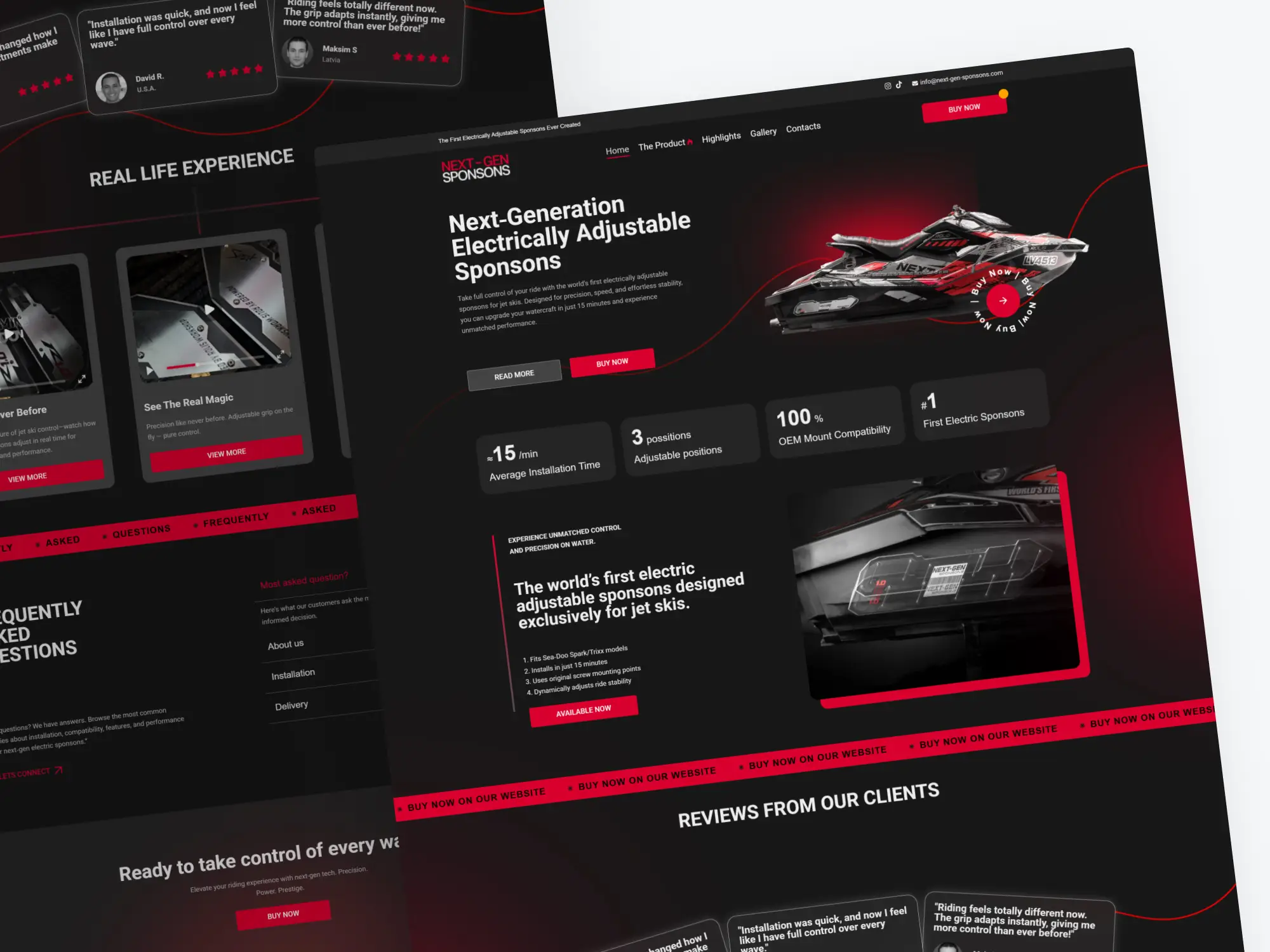

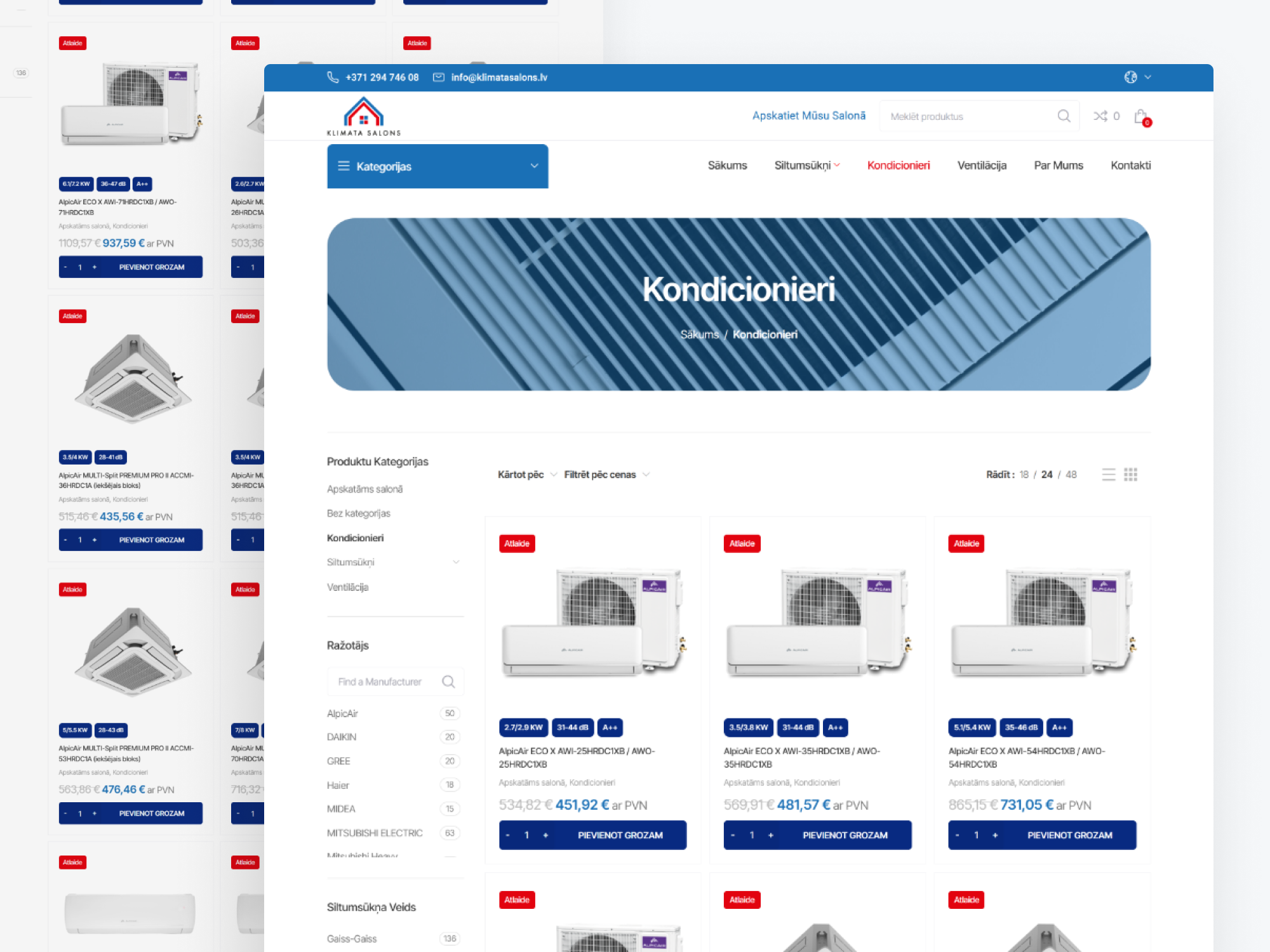

Design

Develop

Deliver

Book a free consultation about Payment Gateway Integration services

Fill out the application form and we will contact you as soon as possible to arrange a consultation time.

What Are Payment Gateway Integration Services? (Beyond Basic Payment Processing)

Strategic payment gateway integration services involve designing, implementing, and optimizing the complete payment infrastructure that processes transactions between your customers, your business, and financial institutions. This goes far beyond simply adding a "Pay Now" button to encompass the entire payment ecosystem.

Think of it as the difference between having a basic cash register versus a sophisticated point-of-sale system that handles multiple payment methods, loyalty programs, inventory updates, and sales analytics. Professional payment integration means:

Conversion-Optimized UX: Designing payment flows that minimize friction and guide customers smoothly to completion.

Multi-Gateway Strategy: Implementing intelligent payment routing that maximizes approval rates and minimizes costs.

Security by Design: Building PCI-compliant solutions that protect customer data and reduce fraud liability.

Global Commerce Enablement:Supporting local payment methods, currencies, and regulatory requirements for international expansion.

Business Intelligence Integration: Connecting payment data with your CRM, accounting, and analytics systems.

The Hidden Costs of Poor Payment Experiences

Many businesses underestimate how much their payment process impacts their bottom line:

Cart Abandonment

70% of shopping carts are abandoned, with complicated checkout processes being a leading cause.

Lost International Sales

Inability to accept local payment methods can reduce international conversion rates by 50% or more.

Fraud Losses

Inadequate security measures can lead to chargebacks, fraudulent transactions, and compliance penalties.

Operational Inefficiency

Manual reconciliation of payments across multiple systems wastes valuable staff time.

Customer Distrust

A clunky or unprofessional payment experience damages brand perception and reduces repeat business.

Our Payment Integration Methodology: Building for Conversion & Security

We follow a comprehensive approach to ensure your payment integration delivers both immediate results and long-term value.

01

Payment Strategy & Gateway Selection

We begin by analyzing your business model, target markets, average transaction values, and growth plans. We help you select the optimal payment gateway(s) based on fees, features, geographic coverage, and integration complexity.

02

Secure Integration Architecture

Our developers build robust, PCI-compliant integration architectures. We implement tokenization, secure card storage, and proper data handling to minimize your PCI DSS scope and protect sensitive payment information.

03

UX-Optimized Checkout Implementation

We design and implement checkout experiences that follow payment UX best practices: minimal form fields, clear error messages, progress indicators, and mobile-optimized interfaces that reduce cognitive load and build trust.

04

Testing, Compliance & Fraud Prevention

We conduct rigorous testing across devices, browsers, and payment scenarios. We implement fraud detection rules, address verification, and 3D Secure authentication to balance security with conversion optimization.

05

Ongoing Optimization & Support

Payment integration isn't set-and-forget. We monitor performance, analyze abandonment points, A/B test improvements, and ensure your payment system adapts to new regulations and customer expectations.

Key Benefits of Professional Payment Integration

Higher Conversion Rates & Reduced Cart Abandonment

Streamlined, trustworthy payment experiences that guide customers to completion without friction or confusion.

Enhanced Security & Fraud Protection

Enterprise-grade security measures that protect your business from fraud losses and compliance violations.

Global Payment Capabilities

Support for international customers with their preferred payment methods and local currencies.

Flexible Payment Options & Methods

Offer customers their preferred way to pay—credit cards, digital wallets, bank transfers, buy-now-pay-later, and emerging payment technologies.

Simplified Reconciliation & Reporting

Automated synchronization of payment data with your accounting, CRM, and analytics systems for accurate reporting and reduced manual work.

Our Payment Gateway Integration Services

01

Multi-Gateway Integration & Routing

Don't put all your eggs in one basket. We integrate multiple payment gateways and implement intelligent routing logic to maximize approval rates, provide fallback options during outages, and optimize costs based on transaction type and geography.

02

Custom Payment Solution Development

When off-the-shelf solutions don't meet your unique business needs, we build custom payment processing logic, specialized subscription billing engines, or marketplace payout systems that handle your specific business model.

03

Subscription & Recurring Billing Integration

For SaaS companies and subscription businesses, we implement sophisticated recurring billing systems with features like:

Flexible billing cycles and prorations

Automated dunning management for failed payments

Customer self-service portal for subscription management

Usage-based billing and metered pricing

04

Mobile & In-App Payment Integration

We implement native payment experiences for iOS and Android applications using platform-specific payment SDKs (Apple Pay, Google Pay) while maintaining consistency with your web payment flows.

05

International Payment & Currency Support

Expand globally with confidence. We implement multi-currency pricing, dynamic currency conversion, and support for local payment methods like iDEAL (Netherlands), Alipay (China), SEPA (EU), and dozens of other region-specific options.

06

PCI DSS Compliance & Security

We build payment solutions that reduce your PCI compliance burden through proper architecture, tokenization, and secure development practices. We guide you through compliance requirements and implement the technical controls needed to protect customer data.

Payment Gateways We Integrate

Major Processors: Stripe, PayPal, Braintree, Authorize.net

Regional Specialists: Adyen, Worldpay, Checkout.com

Alternative Payments: Apple Pay, Google Pay, Amazon Pay

Buy Now, Pay Later: Klarna, Affirm, Afterpay

Bank Transfers: ACH, SEPA, Open Banking

Platform-Specific: Shopify Payments, WooCommerce Payments

Frequently Asked Questions (FAQs) About Payment Integration

Q: How long does payment gateway integration typically take?

A: A standard single-gateway integration takes 2-4 weeks. Complex multi-gateway systems with custom functionality can take 6-8 weeks. We provide detailed timelines after understanding your specific requirements.

Q: What's the difference between a payment gateway and a payment processor?

A: A payment gateway captures and transmits payment data (the "virtual terminal"), while a payment processor handles the actual transaction with banks. Many modern providers like Stripe combine both functions.

Q: How do you handle PCI compliance?

A: We implement architectures that minimize your PCI scope through tokenization and secure redirects/hosted payment fields. While we handle the technical compliance aspects, you'll still need to complete the annual SAQ (Self-Assessment Questionnaire).

Q: Can you help us reduce payment processing fees?

A: Yes, through strategies like intelligent gateway routing, optimizing for interchange-plus pricing, implementing SCA exemptions where applicable, and selecting the right processor for your business model and transaction patterns.

Q: What if we need to change payment processors in the future?

A: We build abstraction layers that make switching processors significantly easier. While some re-integration is always needed, proper architecture minimizes lock-in and reduces the cost of future migrations.

Q: Do you support marketplace or platform payment models?

A: Absolutely. We have extensive experience with marketplace payment architectures including split payments, escrow services, delayed payouts, and complex fee structures.

Conclusion

Your payment process is more than a technical necessity—it's the crucial moment where customer intent transforms into revenue. A poorly executed payment experience can undermine your marketing investments, damage customer relationships, and leave money on the table. With Trinity DEV's payment gateway integration services, you transform checkout from a potential obstacle into a seamless, secure, and satisfying conclusion to the customer journey.

Stop losing sales at the final hurdle. Contact Trinity DEV today for a free payment experience audit. Let's analyze your current checkout process and design a payment integration strategy that maximizes conversion and supports your business growth.

On this page

- 1. Introduction: The Final Hurdle: Transforming Payment Friction into Conversion

- 2. What Are Payment Gateway Integration Services? (Beyond Basic Payment Processing)

- 3. The Hidden Costs of Poor Payment Experiences

- 4. Our Payment Integration Methodology: Building for Conversion & Security

- 5. Key Benefits of Professional Payment Integration

- 6. Our Payment Gateway Integration Services

- 7. Payment Gateways We Integrate

- 8. Frequently Asked Questions (FAQs) About Payment Integration

- 9. Conclusion